How to Make Hybrid Pricing Models Work

In Why SaaS Companies are Considering Hybrid Models, we looked at three reasons why many SaaS businesses are considering hybrid pricing metrics.

Accelerated revenue growth. Zuora, Maxio and other companies that track subscription growth have found that companies with hybrid pricing grow faster.

More flexibility. Having two or three pricing metrics makes it easier to adjust revenue mix as economic conditions change.

Better tracking of price and value. Most B2B SaaS companies provide value in more than one way, and it is easier to connect price to value with two or three pricing metrics.

What do we mean by ‘hybrid pricing’? Hybrid pricing is the use of two or more pricing metrics to determine the price paid for a solution.

Pricing metric: The unit of consumption for which a buyer pays.

Value metric: The unit of consumption by which a user gets value.

Research from Zuora and Maxio has found that hybrid pricing models lead to more resilient revenue streams and faster growth.

Barriers to adopting hybrid pricing

With so much evidence that hybrid pricing leads to better business outcomes, why isn’t everyone adopting it? Two reasons are commonly given. Hybrid pricing is too complex. Hybrid pricing is too hard to implement.

Too complex

The most common reason given is ‘fear of complexity.’ SaaS businesses, especially product led growth businesses, are looking for frictionless revenue growth and there is a perception that having two pricing metrics complicates everything. Does it?

Hybrid pricing takes more thought to design and implement. But these are upfront costs. They do not impact operations. And as it is easier to align price, value and costs at different scales with two pricing metrics, hybrid pricing usually makes scaling easier.

In fact, most companies actually have some form of hidden multi-factor pricing. Pick a pricing page from one of your favorite SaaS vendors. Here is a pricing screen from customer success management platform Totango.

There is only one price shown, but there are at least two pricing metrics: users and customer accounts. There is additional package fencing for functionality, collaboration, support and integrations (SCIM and SSO). Fencing are value metrics that are used to guide buyers to a specific package.

Mailchimp is another example. Here is the pricing page.

Again, there is one price but two pricing metrics: monthly email sends and number of users. Note how Mailchimp presents its highest price offer, Premium, on the left of the screen. English readers tend to scan from left to right, and the first price we see becomes the anchor price that we use to evaluate the price of the other offers.

Hybrid pricing is common in SaaS and buyers are used to hybrid pricing models. Sales teams can quickly learn to appreciate the flexibility of a hybrid model and use it to close sales.

Too hard to implement

Another obstacle to hybrid pricing can be the pricing and billing systems. Some applications make it difficult to support hybrid pricing models and in all cases there will be an investment needed to configure systems to support the pricing and to train sales on how to communicate value and connect value to price.

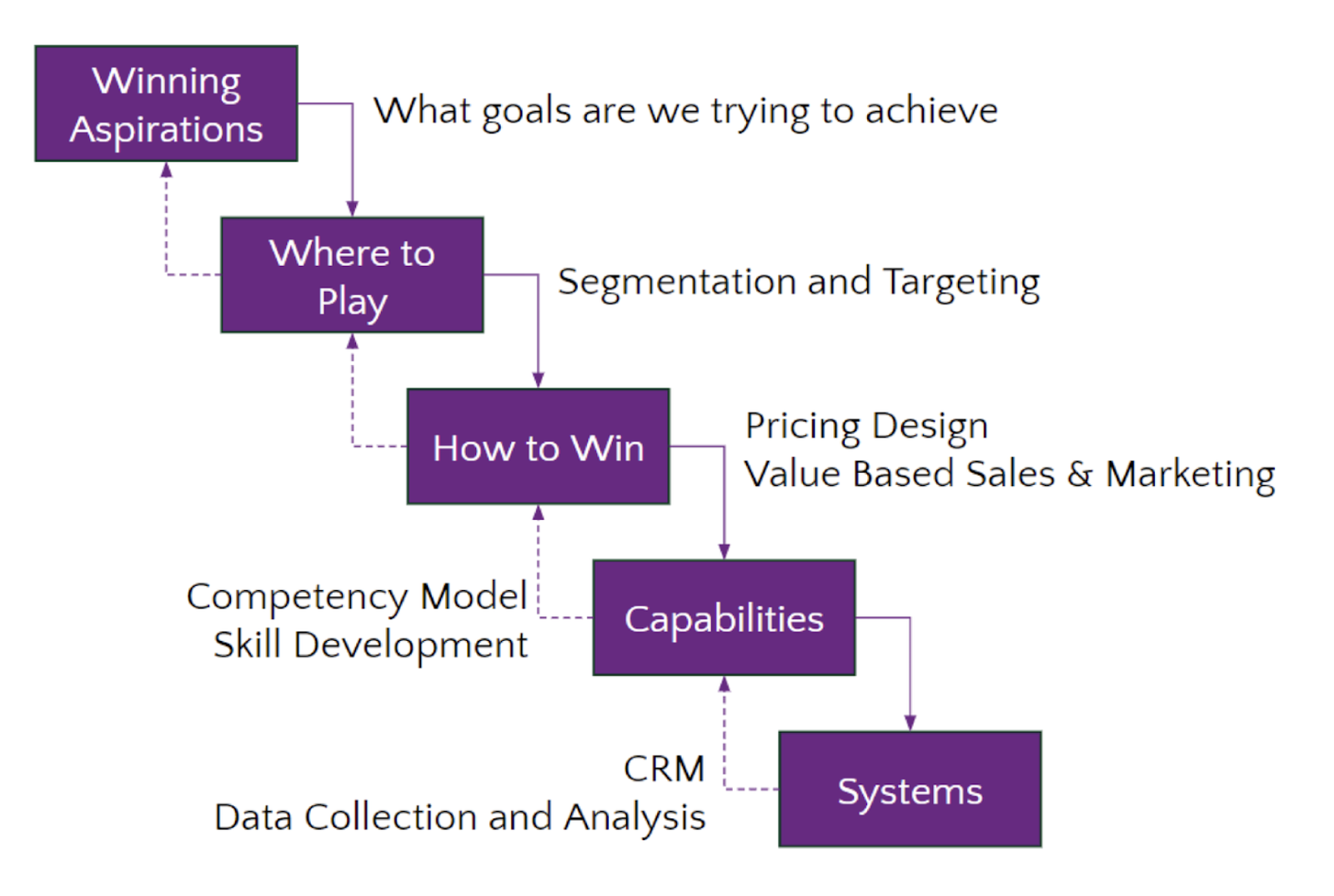

Is this a legitimate objection? Well, ‘no pain, no gain,’ as they say in physical training. And if your systems are determining how you price then it is time to change your systems. There is a reason that Systems is at the bottom of Roger Martin’s playing to win choices (also known as the strategic choice cascade).

Good sales people work hard to communicate value and put price in the context of value. They generally appreciate hybrid pricing as it gives more options while avoiding the need to rely on discounts.

How to choose the two pricing metrics

How do you go about choosing pricing metrics?

Good pricing metrics do three things.

Connect price to value and thereby help to communicate value

Scale across the full range of customers you serve

Provide flexibility to adapt to changing economic conditions

Start with value. Build a formal value model. This is a system of equations that describes how you deliver value to a specific customer. The equations have variables. Some variables will be more powerful than others, and some value drivers will matter to some clients and not to others.

Then explore different scenarios. What variable drives the most value? Does that change when you change segments? Are some variables correlated (they change together)? Answering these questions will help you pick a small number of variables to use as pricing metrics. You may want to combine two value variables into one pricing metric. But don’t get too fancy here. Keep things as simple as possible (but no simpler, as Einstein says).

You are looking for two or at most, three pricing metrics that will

Give you a stable source of revenue.

Scale up as you deliver more value (and yes, scale back down if value declines.)

Be easy to explain.

You want two pricing metrics that can move independent of each other. If the two pricing metrics are tightly correlated then you don’t need both of them. This is true of Hubspot's two metrics: Users and Contacts can scale independently of each other. Totango also leverages the User and Customer Accounts as its two metrics.

One does not have to use Users as one of the metrics. Here is an example for Valio where the two metrics are Number of Models and ARR Managed.

There are two pricing metrics:

Number of Models

ARR of Accounts Managed on the Systems (which kicks in from year two and is a trailing metric)

The stable metric is the number of models. The scaling metric is ARR based. The scaling metric is a trailing metric to make the pricing predictable.

There is no limit on the number of users, we want as many people using the software as possible. The number of integrations included is used as a fence.

Hybrid pricing models are becoming more and more common because they are in the interest of both buyer and seller.

For buyers, hybrid pricing can limit the risk of buying software that fails to get adopted (back in on-premise days, we called this ‘shelfware’). If the pricing metrics do a good job of tracking value, buyers are generally willing to pay more if they are getting more value.

For sellers (vendors) hybrid pricing generally delivers higher revenues over time (providing you are really providing value) and will make it easier to respond to changing economic conditions.

To take your pricing to the next level, consider introducing a hybrid pricing model.

Steven Forth is managing partner at Ibbaka, a software platform for pricing and customer value management. He advises leading SaaS companies on their pricing strategy and design and how to communicate and document value.